Welcome to 2019, I hope you had an incredible New Year. We’ve been thinking about what we can deliver to our current and former students that would allow you to meet or exceed your credit goals in 2019.

Here

is my gift to you. I’m calling it the Credit Score Decoder. It’ll help

you understand how to manage and maintain your Credit. I’ll dive right

in…

You

have 50+ different variations of your credit score, this is your scores

are so different based on where you check them. For this example, we

are going to focus on the primary credit score algorithm used by

lenders, it’s called FICO scores.

Your FICO score ranges from 300-850. Your primary goal should be to achieve 740+ scores. Anything higher than 740 is overachieving, it won’t save you any money, but it’ll definitely feel good!

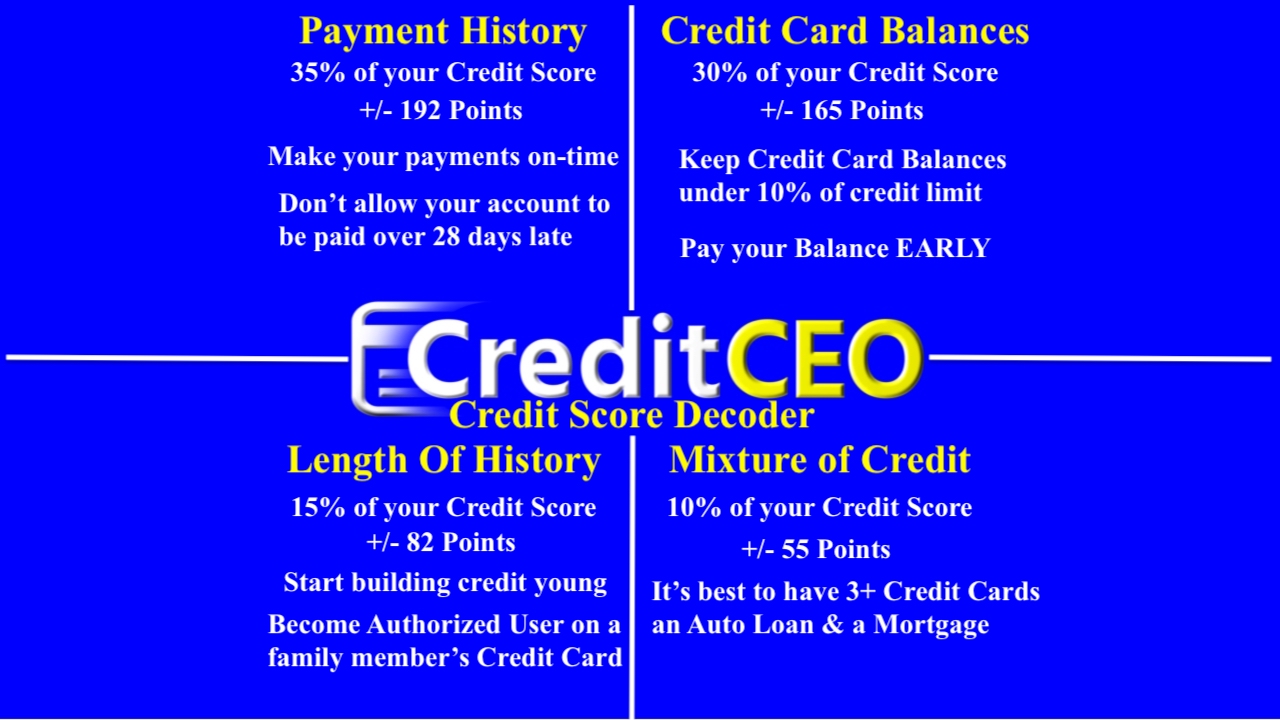

There’s a total of 550 points that you can achieve, I’m going to explain how it’s broken down. I haven’t included the final 10% of your score in the Credit Score Decoder, so I’ll explain below…

Here is how your credit score is broken down or decoded…

35%

– Payment History – Make your payments on time, if you think you are

going to be more than a few days late on a payment, call the creditor

right away and try to make arrangements. CreditCEO Tip – If you are

going to be late on a credit card, buy something with that card that is

worth more than the minimum payment, wait a few days and return the

item. That will count as a payment and you won’t be reported late!

30%

– Credit Card Balances (Utilization Ratio) – If you want to maximize

your credit score, make sure that you keep your credit card balances

low. Ideally, you want to keep the balance under 10% of the credit

limit. CreditCEO Trick – You can use the Authorized User trick below to

decrease your utilization ratio and increase your credit score.

15%

– Length of History – If you can, start building credit early and don’t

close any of your old credit card accounts, even if you don’t use them.

CreditCEO Tip – You can add yourself to a family members credit card

and adopt the complete credit history and utilization ratio of that

credit card.

10%

– Mixture of Credit – The ideal mixture of credit is 3+ credit cards,

an auto loan and a mortgage. We can show you how to improve your credit,

so you can qualify for the lowest rate and payment.

10% – Inquiries/New Credit – You want to minimize how often you are applying for credit. “Don’t apply for credit if you’re not going to get it.” You can check your own credit and it won’t count as an inquiry against you. You should check your credit often, make sure you have high scores before you apply for anything.

If you need help with your credit, you can schedule a free, no-obligation consultation here: https://www.BetterCreditGuaranteed.com/