The worst part of applying for a Credit Card is not knowing if you’re going to get approved and having a hard inquiry ding your Credit Report. One of the tactics that I teach my clients is how to get approved for a Credit Card without even applying or causing a hard credit inquiry, which can lower your credit scores. Inquiries stay on your Credit Report for 24 months, but they only weigh down your actual FICO credit score for 12 months. If you’ve got a lot of inquiries on your report, you can be denied for a Credit Card or Loan because the banks think you’re desperate to obtain Credit.

No Hard Inquiry Credit Card Approval

So you want to get approved for a Credit Card, but you don’t want to cause a hard inquiry on your Credit Report? It’s not impossible by any means. The first step is to have good credit, typically a 700 or above Credit Score. If you’ve got bad credit and want to repair some things, you can always visit our website: https://www.BetterCreditGuaranteed.com/ Once you’ve got good credit, you need to make sure you’ve made all your payments on time and have a low balance on all your Credit Cards. Your Credit Card Balance is 35% of your overall credit score This process won’t work if you don’t have at least 2 or 3 open credit cards with over 24 months of positive payment history (the longer the better).

Credit Requirements For No Hard Inquiry Credit Cards

Make sure that you’re utilizing every credit card you have, every month. Make a small purchase, make a payment each month, but leave a small balance on every Credit Card. I usually leave $5 on each Card, showing the Credit Bureaus that I need to make a payment each month, and giving the bank a few pennies in interest, keeping both happy. If you pay your Cards off in full each month, the Bureaus only see your Credit Cards with $0 balance, which will slightly lower your score vs. leaving a balance.

Having An Established Credit/Banking Relationship

If you’ve been following the principals I talked about earlier where you’re using all your Cards each month and leaving a small balance, you’re maximizing your Credit Score. This is one of the key aspects to having great Credit anyways, so it’s good to always follow those directions. I’ve got 19 Credit Cards and I try to use all of them each month. It’s not always possible, but I use them all every few months, just to keep the accounts open. Banks sometimes close or lower the credit limit of inactive credit card accounts, adversely affecting your credit scores.

By following those principals, you’ve also established a relationship with your Credit Card Companies, Bank or Credit Union. (Note: I ALWAYS recommend opening Credit at a Credit Union vs. a Bank because Banks and Credit Bureaus Profit From Consumers With Bad Credit!) Because you’ve made all your payments on time, but kept feeding the bank a few pennies in interest each month, they will WANT to give you more Credit. So I’ll explain the two different ways that you can get approved for a credit card with no hard inquiry.

Request Credit Limit Increases Regularly

One way to do this is to give your Credit Card Company a phone call, ask to speak to a manager and have them look at your account. You will tell them, “I’ve been with your company for xx years and I’ve noticed that I haven’t been granted a Credit Limit Increase recently, I’d like to see if you’re able to increase my Credit Limit WITHOUT pulling my Credit Report, I don’t want to cause a hard inquiry.” Now, if you’re talking to a Bank, they might say no. But Credit Unions and Companies like Capital One will most certainly increase your Credit Limits just by asking. Sometimes they may tell you that they will so a “soft credit pull” which doesn’t cause an inquiry on your Credit, this is fine, you can have them do a soft pull.

This is where having an established relationship and positive payment history with them will really pay off.

Applying For A No Hard Inquiry Credit Card

The same principals are going to apply when you’re applying for a no hard inquiry credit card. You will want to call the Credit Card company that you’ve established a relationship with, talk to a manager and see if they are able to approve you based on your past history with the institution, not your current credit history. Note: They will not always say yes, but when they do, it really pays off. Make sure that you are clear that you don’t want a credit card and no hard inquiries. You can also ask them to approve you based on your average daily account balance (if you keep over 10k in an account with them) or ask them to approve you based on your past payment history with them. Be clear that you want No Hard Credit Inquiries.

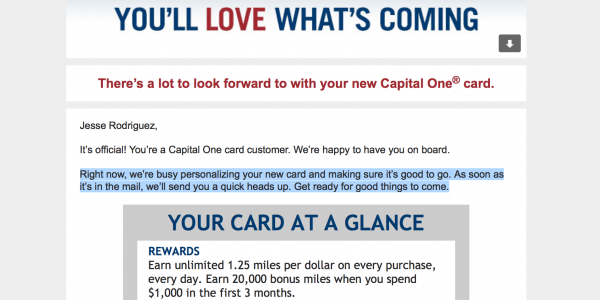

How I got a Credit Card Without An Inquiry

I’ve been a long standing client of Capital One. When I was re-establishing credit, they were one of the only companies that would allow me to have a Secured Credit Card, which after a few years became an Unsecured Credit Card. I’ve had an impeccable payment history with them and I wants to see if I was able to get a Credit Card without applying or causing an inquiry. Capital One regularly increases my Credit Limit, so I figured that it couldn’t hurt to try. It took two weeks to get a decision back, but I got an email that says, “Your Card Is On The Way” and they approved me for a $10,000 Credit Limit with 12 months of 0% interest on purchases.

So the proof is here, if I can do it, you can too! It has not been an easy road to have good credit, but it was worth all the struggle!

If you have any questions about your Credit, or you’re looking to get into our, you can click the link to our website: https://www.BetterCreditGuaranteed.com/ or give us a call at 1-800-216-2725